By Michael Macagnone, CQ-Roll Call (TNS)

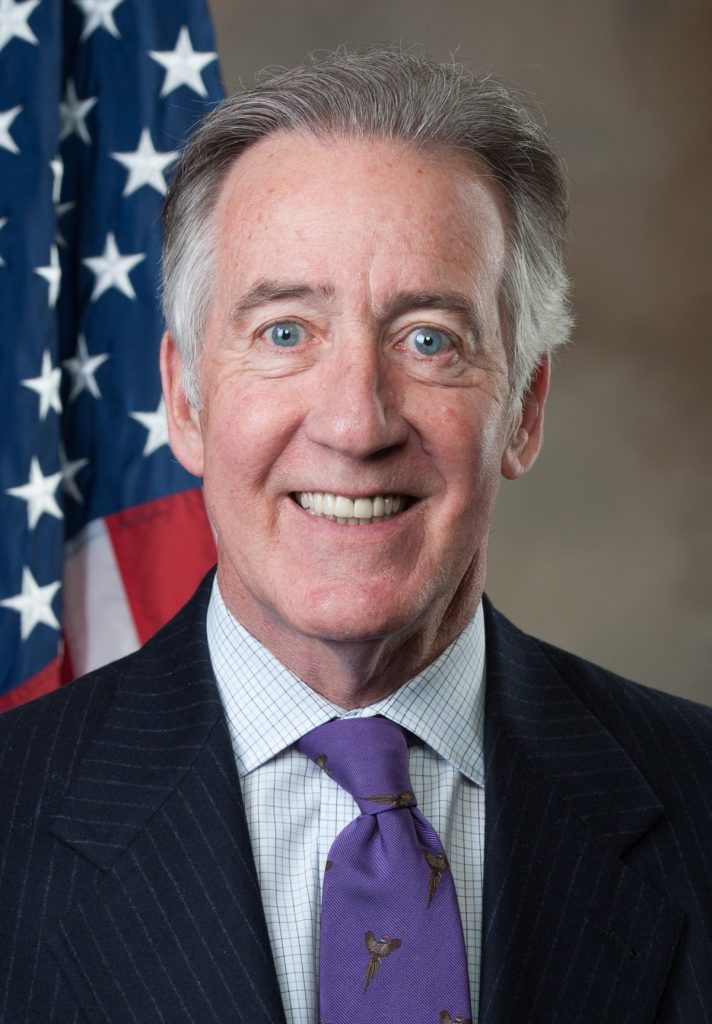

The Supreme Court should not keep former President Donald Trump’s tax returns from Ways and Means Chairman Richard E. Neal, House attorneys told the justices in a filing Thursday.

The House urged the justices to reject Trump’s emergency request to pause lower court rulings that would allow the Massachusetts Democrat who leads the tax-writing committee to access personal tax records of the former president and several of his businesses.

And the House asked the justices to decline Trump’s request for a full appeal in the long-running dispute, since any delay would “leave the Committee and Congress as a whole little or no time to complete their legislative work during this Congress, which is quickly approaching its end.”

The committee may also be in Republican hands next Congress, and the party is not likely to continue the pursuit of Trump’s tax returns.

Last month, the full U.S. Court of Appeals for the District of Columbia Circuit declined to revisit an earlier ruling from a three-judge panel of that same court that concluded Neal could access the returns from the IRS under a federal law.

The House on Thursday argued that Neal presented the request to the Treasury Department with a valid legislative purpose: investigating whether the agency could properly handle a president with such “unique” business interests as Trump.

Any inquiry about the potential motivations of the request, as Trump has sought, would have the effect of “preventing Congress from completing any investigation involving a former president whenever there are allegations that the investigation was politically motivated,” the House lawyers told the justices.

Trump for years has fought in court to prevent congressional access to the returns. He argued in the courts below and his Supreme Court emergency request that the panel seeks to use the returns against him politically.

“The Committee’s purpose in requesting President Trump’s tax returns has nothing to do with funding or staffing issues at the IRS and everything to do with releasing the President’s tax information to the public,” Trump’s request said.

The Biden administration backed up Neal’s request in its own filing Thursday. Prior Supreme Court rulings prevent Trump’s “attempt to have the courts look behind the request’s stated legislative purpose to the subjective motives of individual legislators,” the Biden administration told the justices.

“Under the particular circumstances of this case, the Chairman’s request for applicants’ tax information is both within the Committee’s authority and consistent with the separation of powers,” the Biden administration filing stated.

This is the first time the panel has requested the returns of a president, but Trump himself broke long-standing practice by refusing to release his own returns since launching his presidential campaign in 2015.

Trump cited ongoing IRS audits to justify his reticence; however, the first president to do so, Richard Nixon, released his while under audit.

Neal first sued the administration in 2019 after the Trump administration’s Treasury Department refused to comply with the request for the returns. The agency called Neal’s reasoning for the request pretextual.

After the start of the Biden administration, Neal reissued the request. The Treasury Department said it would comply, after which Trump sued seeking to block the release.

The D.C. Circuit panel decision found Neal’s request complied with the law and the judges had no reason to question the committee’s motives.

“The mere fact that individual members of Congress may have political motivations as well as legislative ones is of no moment,” the D.C. Circuit panel wrote.

_____

©2022 CQ-Roll Call, Inc., All Rights Reserved. Visit cqrollcall.com. Distributed by Tribune Content Agency, LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, Taxes